CPF Contribution Fee

CPF Contribution Fee

Blog Article

Title: **Navigating Monetary Safety: A Comprehensive Manual to CPF Contribution Prices in Singapore**

Introduction:

In the vibrant financial landscape of Singapore, money setting up and protection are paramount. Central to This is actually the Central Provident Fund (CPF), a comprehensive social security procedure that plays a pivotal job in safeguarding the economical very well-currently being of Singaporeans. This post aims to supply an in-depth exploration from the CPF contribution rates, shedding light-weight on their own significance, structure, and implications for people plus the broader overall economy.

**Comprehension the CPF:**

The Central Provident Fund (CPF) is a comprehensive social security procedure in Singapore intended to supply monetary security for citizens in the course of their life. Set up in 1955, the CPF has evolved over time, encompassing a variety of strategies and accounts that cater to different components of someone's economic journey, such as retirement, Health care, and residential ownership.

**CPF Contribution Prices:**

CPF contribution rates stand for the percentages of someone's revenue which are put aside for contribution for their CPF accounts. These prices are structured to address unique fiscal wants, such as retirement price savings, Health care coverage, and housing.

1. **Everyday Wage (OW) and extra Wage (AW):**

- CPF contributions are categorized into Ordinary Wage (OW) and extra Wage (AW). The Common Wage consists of somebody's regular wages, although the Additional Wage encompasses bonuses, time beyond regulation pay out, and other variable factors.

2. **Employee and Employer Contributions:**

- CPF contributions require both equally employees and employers. The contribution costs are divided into the worker's share plus the employer's share. These premiums change based on the worker's age and the sort of income (OW or AW).

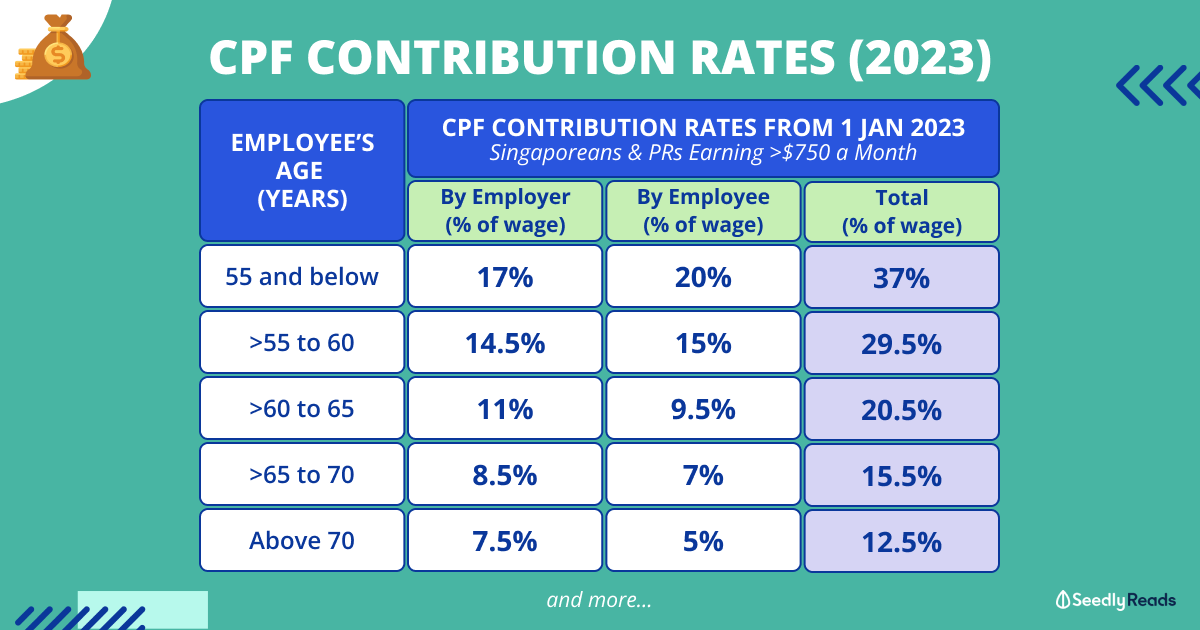

**CPF Contribution Premiums by Age:**

The CPF contribution fees are structured to adapt towards the modifying money needs of people at distinctive stages of their life.

one. **Beneath fifty five Yrs Old:**

- For employees under fifty five yrs aged, the entire CPF contribution fee is 37%. Out of the, the worker contributes 20%, whilst the employer contributes 17%. The Regular Wage (OW) and Additional Wage (AW) have distinct contribution prices for the two staff members and businesses.

two. **55 to 60 Several years Aged:**

- The contribution rates are adjusted as men and women enter the age team of 55 to 60. In the course of this era, the worker contribution amount remains at 20%, though the employer contribution price is minimized to 13%. The adjustment is geared toward slowly shifting the emphasis from accumulation to preparing for retirement.

three. **Above 60 Yrs Previous:**

- The moment somebody crosses the age of 60, the CPF contribution fees bear additional changes. The worker's contribution continues to be at 20%, although the employer's contribution decreases to nine%. This reduction reflects the evolving economic priorities as people today solution their retirement years.

**CPF Contribution Costs for Self-Employed Individuals:**

Self-employed folks in Singapore also are needed to add to their CPF accounts. The contribution premiums for self-employed men and women vary from those for employees.

one. **Medisave Contribution:**

- Self-used persons contribute a share of their Internet trade money to their Medisave accounts, addressing Health care needs. The Medisave contribution amount is tiered, with higher costs for older folks.

two. **Unique and Retirement Accounts:**

- Besides Medisave, self-utilized persons contribute to their Specific and Retirement Accounts. The rates fluctuate dependant on age, with a greater proportion allotted to the Retirement Account for people aged fifty five and above.

**Importance of CPF Contribution Fees:**

Comprehending the importance of CPF contribution rates needs a nearer take a look at how these contributions serve as a Basis for economical security and essential life milestones.

1. **Retirement Personal savings:**

- The CPF is a cornerstone of retirement organizing in Singapore. The contribution premiums are structured to make sure a regular and gradual accumulation of resources over a person's Doing work years. As workers development in age, the allocation to retirement-concentrated accounts increases, laying the groundwork for any fiscally protected retirement.

2. **Healthcare Protection:**

- Medisave contributions Engage in an important purpose in addressing Health care expenses. The tiered contribution charges for Medisave are made to support the switching healthcare needs of individuals because they age. This makes certain there are adequate funds set aside to protect health care charges, together with hospitalization and outpatient treatment plans.

3. **Dwelling Ownership:**

- The CPF also supports residence possession through the allocation of money on the Ordinary Account. Folks can use their CPF savings to finance the acquisition of a home, decreasing the money stress related to housing loans.

four. **Adaptability to Lifetime Phases:**

- The tiered structure of CPF contribution premiums acknowledges the evolving fiscal priorities at diverse life stages. As men and women development from their early working many years for their retirement yrs, the allocation of contributions adapts to fulfill altering wants, fostering money steadiness at each stage.

**Implications for Companies:**

CPF contribution premiums have implications for businesses beyond becoming a fiscal obligation. These are intertwined with workforce administration, financial organizing, and compliance with labor rules.

one. **Expense of Work:**

- For employers, CPF contributions signify a major part of the general expense of work. Understanding these contributions is essential for budgeting and economic arranging within just corporations.

2. **Workforce Planning:**

- The CPF contribution prices also affect workforce arranging. Companies should evaluate the financial implications of hiring workers in numerous age brackets, Specially as being the contribution premiums transform with age.

three. **Compliance and Reporting:**

- Making sure compliance with CPF contribution requirements click here is a legal obligation for employers. Adhering towards the stipulated contribution charges and precisely reporting contributions are vital facets of labor legislation compliance.

**Issues and Things to consider:**

Though the CPF procedure is a strong framework for economical stability, it is not without challenges and concerns.

1. **Adequacy of Retirement Funds:**

- The adequacy of CPF funds for retirement is a topic of discussion. Some individuals may find the CPF savings insufficient to meet their desired standard of residing in retirement. This highlights the necessity of own economical scheduling and supplementary retirement price savings.

two. **Impression of Financial Improvements:**

- Financial fluctuations can affect the CPF technique. Alterations in employment patterns, wage ranges, and economic conditions may impact the success of CPF contributions in Conference the evolving money demands of people.

3. **Versatility and Withdrawal Guidelines:**

- The rigidity of CPF withdrawal policies continues to be a subject of debate. Some people today may perhaps search for larger overall flexibility in accessing their CPF money for certain requirements, like education or housing. Balancing the necessity for adaptability Along with the very long-expression ambitions in the CPF program is really a consideration for policymakers.

**Summary:**

The CPF contribution fees in Singapore undoubtedly are a elementary facet of the nation's social security procedure, addressing the money desires of individuals all through their lives. From retirement price savings to Health care protection and home ownership, CPF contributions Participate in a pivotal position in shaping fiscal safety and well-remaining. Knowledge the nuances of CPF contribution costs is crucial for individuals, businesses, and policymakers alike because they collectively navigate the intricacies of financial planning and social stability while in the dynamic economic landscape of Singapore.